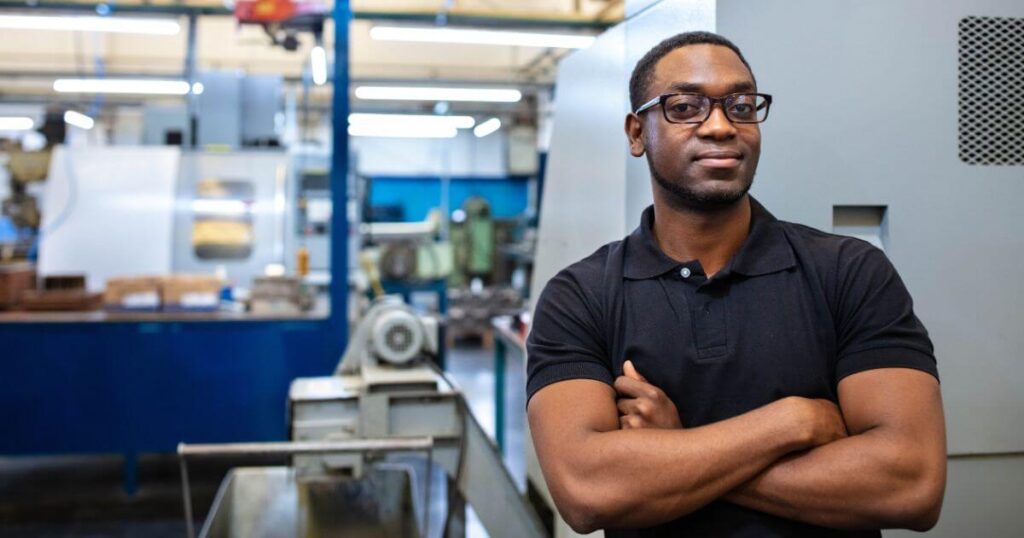

Imagine this: You’re managing a busy production floor with tight deadlines, high output goals, and a workforce that keeps you on your steel-toes.

You’re making hires, keeping the team motivated, and meeting targets, but the turnover in certain roles?

Constant.

The risk of workplace claims?

Always in the background.

This is where payrolling comes in, quietly protecting your business while making workforce management easier and more flexible.

If you’re not familiar with payrolling, here’s the quick lowdown: it’s a service that goes beyond traditional payroll, handling everything from onboarding to the risk management side of employment.

But in industries like manufacturing, skilled trades, and warehouse or distribution environments, payrolling can do something even more powerful: it can protect your business. Let’s dive into how.

Why Payrolling is a Smart Choice in Manufacturing and Logistics

High turnover is a reality in manufacturing and warehouse environments, where demand is relentless and roles often require specialized skills or physical endurance. And with higher churn comes a greater risk of employment-related claims — something payrolling helps protect against by shifting the legal and financial responsibility to your staffing partner.

When you bring in Alliance Industrial Solutions as your payrolling partner, for example, AIS becomes the official “employer of record,” handling payroll, benefits, taxes, and claims.

The Protections Payrolling Offers

While every staffing agency can source workers, not all offer the flexibility and protection that comes with payrolling. Here’s how a staffing partner with payrolling services safeguards your business in ways others don’t.

Minimizes Liability & Risk

Reduced liability and greater peace of mind? Yes, please.

As the employer of record, your payrolling provider takes on the legal responsibilities associated with payrolled employees. That includes the big stuff: workers’ comp claims, unemployment claims, and even legal actions tied to workplace issues.

If a claim arises, it’s your provider — not your company — that’s on the hook. This frees you up to focus on production, logistics, and day-to-day operations without worrying about unforeseen employment liabilities.

Prevents Costly Hiring Mistakes

Consider payrolling a “test drive” period for new hires, allowing you to evaluate performance and fit without taking on the full financial or legal responsibility upfront. You’re free to bring on skilled candidates, knowing you can pivot if necessary.

Let’s say you hire for a bulk contract-to-hire situation; payrolling lets you test out talent without the commitment until you’re confident they’re a solid addition to the team.

Hiring Scenarios Where Payrolling Makes Sense

There are certain times when payrolling can be the best protection for your manufacturing business. Here are a few scenarios where payrolling shines.

High-Turnover Departments

Departments facing high turnover — whether on the production line, in the warehouse, or on distribution teams — are perfect for payrolling.

With AIS managing the employment side, you can bring on talent without worrying about the financial burden of repeat onboarding and offboarding costs or any fallout from workplace claims.

Plus, it lets you focus on keeping productivity up, not getting bogged down in employment logistics.

Temp-to-Hire Models

Need to bring in a few candidates on a trial basis before fully committing? Payrolling through a temp-to-hire arrangement lets you see how a candidate performs without taking on the legal responsibility upfront.

This is ideal for bulk contract-to-hire needs, where you can confidently evaluate each employee before extending a full-time offer.

Risk-Prone Positions

Let’s be honest: certain roles are more prone to workers’ comp claims or other employment issues, especially in physically demanding or repetitive tasks. Payrolling provides a buffer, with AIS handling the risk management and liability.

It’s a smart way to shield your business from potential blowback while still meeting workforce needs.

Payrolling: A Flexible, Protective Hiring Solution

In manufacturing, warehouse, and skilled trades, finding a hiring solution that’s both flexible and protective isn’t always easy. Payrolling services offer just that, giving you the freedom to manage talent without the added financial or legal risks.

It’s a simple yet effective way to safeguard your business, allowing you to focus on what you do best — keeping production lines moving, orders filled, and teams strong.

Curious about how payrolling might fit into your hiring strategy? Whether you’re looking to cover high-turnover roles, manage risk-prone positions, or evaluate new talent, AIS is here to help with payrolling services that offer peace of mind and the flexibility your manufacturing and logistics business needs to thrive.